The December 2019 sports betting handle and revenue figures will be released by the Pennsylvania Gaming Control Board later this week, and we have a spoiler for you: FanDuel Sportsbook will be No. 1 in the state.

We don’t have any inside information, mind you. It just seems an extremely safe assumption.

In November, FanDuel took in $149.7 mm in online bets, more than 56% of all virtual wagers taken in total by Pennsylvania’s seven mobile sportsbooks that were active that month. In October, FD generated $113.9 mm in handle, just over 57% of the state’s total action. FanDuel was tops in the state in September as well. And in August — its first full month of operation — the site led the way in handle, provided you regard BetRivers’ separate Philadelphia and Pittsburgh casino sites as two distinct sportsbooks.

The bottom line is that FanDuel Sportsbook has established itself as the dominant mobile sportsbook in PA in these early days of legal sports betting — just as it has in New Jersey for every single month since February 2019.

“I think we had, to be frank, high hopes and high expectations of how we would do in Pennsylvania,” FanDuel Group Chief Marketing Officer Mike Raffensperger told Penn Bets. “Pennsylvania is such a uniquely amazing sports market. Philadelphia is an incredible sports market place, Pittsburgh is an incredible sports town. We were eager to get into Pennsylvania after enjoying a market leadership position in New Jersey and hopefully learning a couple things there.

“But where we have netted out in Pennsylvania has exceeded even our expectations.”

Winning the battle with DFS rival DraftKings

Whereas DraftKings Sportsbook beat FanDuel to the punch in New Jersey and was the handle/revenue leader for several months before FD caught up, it’s FanDuel that got out of the blocks quicker in the Keystone State. DK didn’t start taking online bets in PA until Nov. 4, more than three months after FanDuel.

In 27 days in November, DraftKings’ PA site generated $16.2 mm in betting handle, fifth in the state, some $133 mm behind FanDuel.

How big an edge did FanDuel secure by launching ahead of its old daily fantasy sports rival?

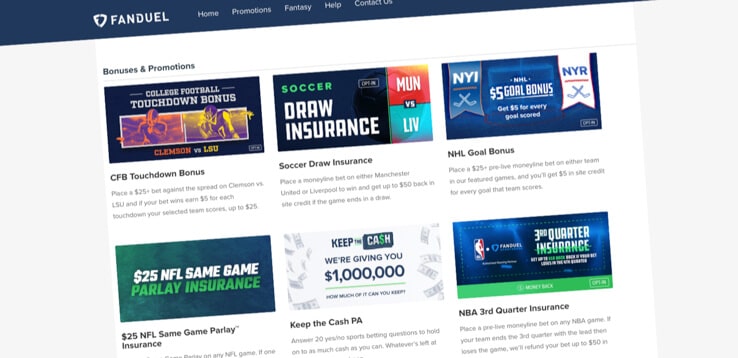

“Certainly, first-mover advantage helps,” Raffensperger conceded. “But what is more fundamentally important, and we see this in the data and in the surveys that we get back from our customers, is having a world-class customer experience, and having generous and, frankly, fun promotions that are innovative, that focus on customer service and user experience. Those are regularly rated among the reasons that people choose us and stick with us.

“So while it certainly helped to have a head start — I think it would be disingenuous for me to deny that — I think the sustained leadership we’ve enjoyed since we both started competing very actively is a testament to the strength of our product, the strength of our brand, and the fun that we bring to bear on the sports betting market with the promotions that we put in place.”

For high-stakes sports bettors, those “fun” promotions and odds boosts are probably not as important as simply offering fair lines. But for the more casual gambler, promotions that insure losing bets up to $50 under certain circumstances, or offer modest bonuses in the form of site credit as certain props are hit, can be a major attraction.

Raffensperger pointed out as one of FanDuel’s most well-received recent promos a Christmas Day NBA special that was offered on both the 76ers-Bucks game and the Clippers-Lakers showdown. For a minimum moneyline bet of $50, bettors received a $3 bonus for every three-pointer their team made.

“I call them Plinko promotions,’” Raffensperger said. “They trickle out throughout the game and it’s like, ‘Ooh, $3. Ooh, $3.’ People have responded really well to those kinds of promotions, and we’ve done them for all sports.”

Indeed, using touchdowns in football, runs in baseball, or goals in hockey, FD has had success with those bonuses. But it was 76ers bettors, more inclined to back the local team than a Milwaukee or L.A. squad, who had the biggest success on Christmas. Not only did the Sixers win, but they went 21-44 from beyond the arc, nearly doubling their average of 10.8 made three-pointers per game.

“That promotion went materially over budget,” Raffensperger said with a chuckle. “But I’ll call it a Christmas Day gift to our Pennsylvania users, and, genuinely, we were happy to do it and we were happy with the response.”

A taxing percentage to the state?

Operating in Pennsylvania is not exactly the same as operating in New Jersey.

For starters, eight online sportsbooks currently compete for customers in PA, whereas New Jersey, which allows up to three “skins” per land-based venue, has 19 mobile books.

And the amount of money sportsbooks pay the state is substantially different. In NJ, there’s a $100,000 license fee and a 13% tax on mobile betting revenue. In PA, the fee is $10 mm and revenue is taxed at 36%.

That means more money for the state and a more challenging situation for operators hoping to profit.

But Raffensperger sees other positives to help balance out those costs of doing business.

“Obviously, the tax rate in Pennsylvania is materially higher than in New Jersey, and that changes the business and our profile in terms of what we’re looking for,” he said. “Generally speaking, Pennsylvania has done a lot of things well with the way that they’ve regulated the marketplace, such as having mobile sign-up access anywhere in the state, so you don’t have to be on the floor of a casino to sign up. It’s a good, competitive marketplace, an open marketplace, where a lot of different operators can participate. And so in that sense, it’s a healthy marketplace, one that we’re happy to be invested in.”

Some operators have expressed more mixed feelings or indicated they’ve entered the Pennsylvania market prepared to operate in the red on sports — with the intention of profiting off online casino or establishing a brand they can build on in states with lower taxes.

FanDuel doesn’t look at PA that way (although it is looking forward to launching iCasino in the state and increasing profits with that vertical). The early Keystone State numbers show that sports betting can be a self-sustaining venture for the FanDuel Group.

“There are numerous aspects of the Pennsylvania market,” Raffensperger said, “that make it an attractive investment from a business standpoint.”