When there just isn’t enough action in a poker game, when the pots are too small and the pulses aren’t racing, a player will sometimes introduce a live straddle. It’s essentially a third blind, double the size of the big blind, instantly injecting excitement into a game that’s gone as flat as the felt it’s played on.

Regulated online poker in Pennsylvania, which is poised to become a reality in 2019 after more than five years in the tank, has a chance to be the live straddle of the American online poker market.

With only Nevada, New Jersey, and Delaware dealt in, online poker keeps trending in the wrong direction. And it certainly isn’t the shiny new toy anymore — not a decade and a half after the poker boom began, not with sports betting getting all the attention.

If there are going to be the beginnings of an online poker revival over the months ahead, the Keystone State is the key. The question is how much of a bump can one state realistically provide, especially almost eight long, frustrating years after Black Friday?

When three of a kind isn’t good enough

Whereas online casinos in New Jersey produced $25.1 mm in revenue in October, online poker managed a paltry $1.65 mm. That poker rake represents a 14.5% year-over-year drop from the $1.93 mm figure of October 2017.

A year ago, poker accounted for 9.4% of New Jersey’s total online casino revenue. Now it makes up just 6.1% of the pie.

There are subsections of the poker revenue numbers that can be viewed in a positive light: PokerStars, fueled by its annual New Jersey Championship of Online Poker, saw revenues increase over the previous month by more than $100,000; Caesars, the umbrella site for both 888 and WSOP.com, is up 15.4% over October 2017 thanks to the tri-state poker compact that allows for shared liquidity between NJ, Nevada, and Delaware.

Still, the overall trend is negative. PokerStars is down 18% year-over-year. And since the initial jolt provided by the tri-state compact starting, that WSOP/888 revenue number has declined every month. We say this not to project doom and gloom, but to initiate an honest discussion about a poker market that has, at best, stagnated without a fourth state in on the fun.

“For WSOP in New Jersey, it was a positive year-over-year comparison, but, yes, the overall trend for the New Jersey market has been downward in terms of revenues,” WSOP.com Head of Online Poker Bill Rini told Penn Bets. “Some of that is to be expected, though. The poker market in Nevada and New Jersey is beginning to mature, so year-over-year comparisons are going to be tough unless you introduce some change that impacts the entire market, like shared liquidity did with Nevada and New Jersey or the way that potential shared liquidity with Pennsylvania can.”

The more the merrier

The P.T. Barnum saying “nothing draws a crowd quite like a crowd” certainly applies to poker, where it’s hard to interest anyone in playing if nobody else is playing.

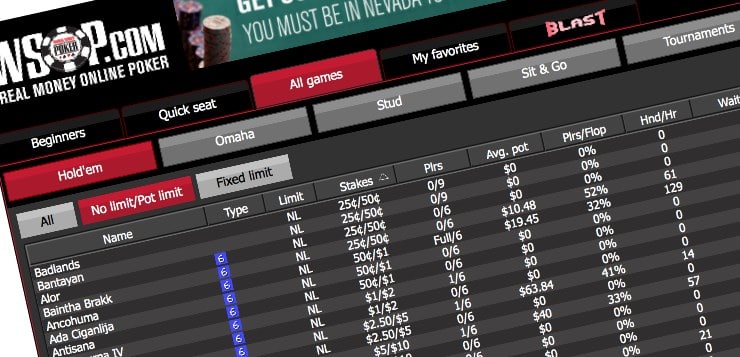

The New Jersey cash game traffic certainly isn’t doing much to draw a crowd these days. Between WSOP/888, PokerStars, and Borgata Poker combined, the average amount of players in action at any given time over the past week was 330, and at absolute peak times, there were just over 700 online poker players seated at all three sites.

Compare that with before the U.S. Department of Justice seized the leading online poker domains on April 15, 2011, when PokerStars had one global player pool that would extend beyond 40,000 during peak hours, and you can see why some might say online poker in the U.S. isn’t exactly thriving right now.

“Poker is obviously a game that benefits from liquidity,” Rini said. “In Nevada, we’ve seen an uptick in the amount of players and revenue since shared liquidity, so, as I like to say, with shared liquidity, one plus one equals some number greater than two.

“It’s difficult to estimate what that greater number is, because it depends on a lot of other variables, but I would expect that adding Pennsylvania into a Nevada-New Jersey-Delaware pool would increase play in all four states.”

Putting up MT stats

Tournament entries are the most straight-forward metric by which to measure poker’s health. (Consider how breathlessly everyone in the industry sweats the World Series of Poker Main Event attendance each year.)

Thanks to shared liquidity, WSOP.com’s MTT scene is putting up encouraging numbers. You wouldn’t want to compare it to the pre-Black Friday days, obviously, but with expectations properly calibrated, the stats are solid.

“A year ago, our combined Nevada and New Jersey Big Sunday guarantees were at $80K — $50K in New Jersey and $30K in Nevada,” Rini noted. “Now we’re running a $100K and hitting the guarantee fairly easily.”

WSOP.com’s Coast to Coast Classic series has been posting strong numbers as well. The first edition, in May, generated $1.4 million in prize money, beating its $1 million total in guarantees. The $1.1 mm August sequel missed its guarantees on 10 of 36 events, but still put forth a respectable performance, especially given that August is often the worst month of the year for online poker sites.

The Coast to Coast Classic III, with its $1.5 million in guarantees, just concluded this past Sunday. WSOP.com only had to pay overlay on nine of 51 tournaments, and the total prizes added up to about $1.85 million.

The marquee events all drew well: The $1K high roller crushed its $85,000 guarantee, stirring up a $130,835 prize pool; the $525 main event pulled in $215K, narrowly beating its $200K promise; and the $500 Pot-Limit Omaha event proved there’s room for more than just hold’em, nearly doubling its $25K guarantee with a $47,634 prize pool.

Just add Pennsylvania …

It’s easy to imagine how adding one state more populous than New Jersey could inflate all of those MTT numbers. With Pennsylvania, maybe a $2.5 million series with a $500K main event is possible.

Yes, it’s a far cry from the Sunday Million glory days. And sure, it might take a state like New York coming aboard to cause a seismic shift.

But PA will instantly change the math if and when player-pooling begins — not just for WSOP/888, but for the whole industry. Eight Pennsylvania properties have indicated they have online poker plans, and both WSOP (partnered with Harrah’s Philadelphia) and PokerStars (Mt. Airy Casino Resort) are ready to go in the state.

Most in the industry are optimistic about the PA effect, including WSOP.com’s Rini, although he warns that anyone tossing around the words “poker boom” needs to temper expectations.

“It’s very difficult to have a boom effect with a state-by-state sort of rollout because a boom, by the very nature of the word, implies huge, explosive growth,” Rini said. “We’re into our fifth year of legalized online gaming and we’re just not seeing the kind of legislative momentum that would produce a boom.

“But I don’t mean that to be a negative reflection on online poker. It will simply be more of a slow ramping up rather than a boom.”