One of the biggest concerns heading into the launch of the Pennsylvania sports betting industry was the juice. And rightfully so.

In order to set up shop, operators in the Keystone State were forced to fork over $10 million in licensing fees, and on top of that, are required to pay a 34% tax on monthly gross revenue to the state and an additional 2% tax as a local share assessment. With such a hostile climate for operators, few would have been shocked if players ended up flipping part of the bill by way of … less than favorable pricing. Would -115, or even -120, become the new -110?

So far it doesn’t appear that way, as a recent perusal of the lines at the newly opened sportsbook at SugarHouse Casino in Philadelphia revealed a house edge that was largely similar to that found on the casino’s New Jersey online sports betting app.

A welcome sight

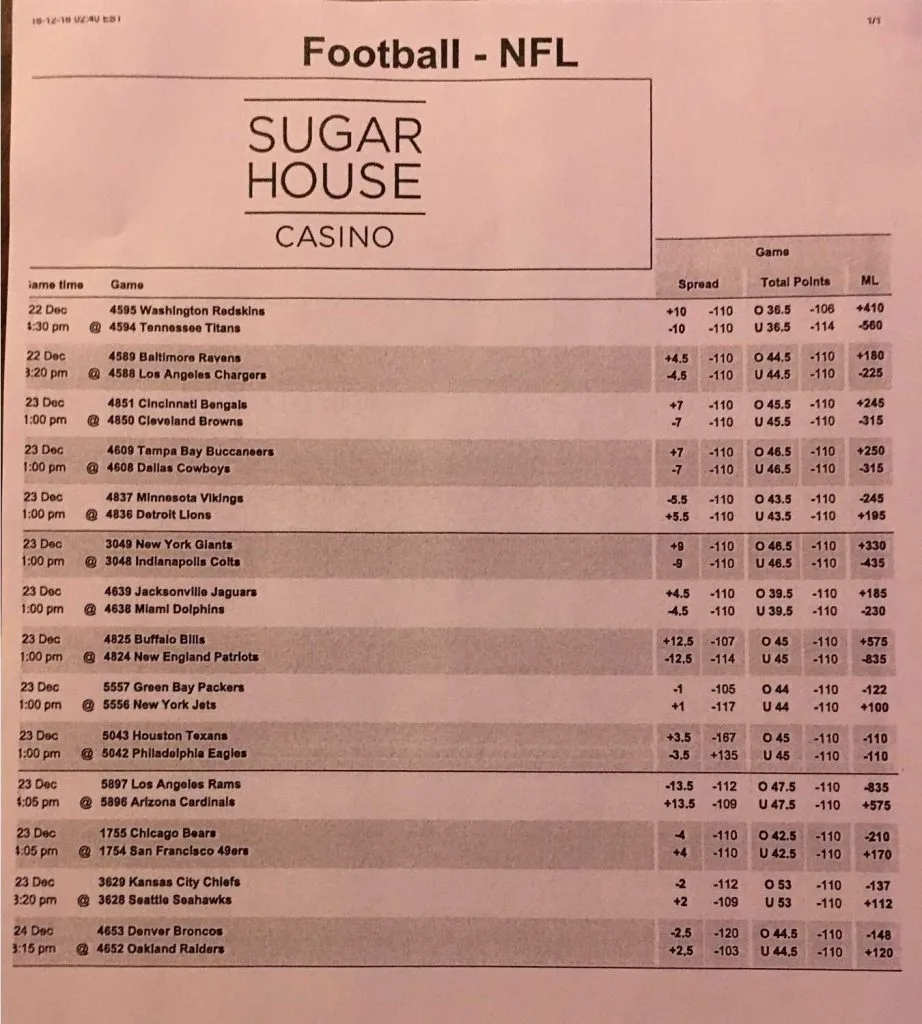

During his field trip to SugarHouse on Tuesday, US Bets Managing Editor Eric Raskin managed to swipe one of the sheets showing the lines for this week’s upcoming NFL games. This is what they looked like:

SugarHouse Casino, like the Play SugarHouse app in New Jersey, is powered by Kambi. Yet, Kambi only sets the lines, offering its clients relative freedom over the margins via its price differentiation tool. That’s why you’ll see the same lines on DraftKings, 888Sport NJ, and Play SugarHouse (all powered by Kambi in New Jersey), but slightly different vig, with Play SugarHouse generally offering better pricing than the other two.

We compared these NFL lines to those listed the same evening on Play SugarHouse in New Jersey, which sees its online sports betting revenue taxed at a much lower rate of 13%. Yet, despite the 23% difference in tax rate, the vig was almost identical across the two SugarHouse properties.

For instance, the Chicago Bears (-4) @ San Francisco 49ers featured a two-way -110 point spread on both sites, and the same -210/+170 money line. Other prices were slightly different, but that was more a reflection of changes in the market. The one big difference, and this could have easily been a typo, was that the money line on the upcoming Houston Texans @ Philadelphia Eagles game was listed at -110 on both sides, which should only be the case if there is no point spread. But when we checked in on the Play SugarHouse app, the Eagles were 2.5-point favorites, making this an insane value play on the Eagles at the land-based SugarHouse Casino book.

Typo, or just darn good publicity for the casino’s home team? We don’t know.

When asked about the differences between the NJ and PA books, Evan Davis, VP and General Counsel at SugarHouse, said, “I can’t tell you exactly what we do in terms of setting individual game lines, but for the vast, vast, vast majority of games, they should be identical to what’s being offered in New Jersey. I can’t tell you that it’ll be 100%.” This effectively affirmed our suspicions that Pennsylvania’s skyhigh tax rate is not going to seriously impact how SugarHouse sets its pricing.

When asked if the forthcoming Play SugarHouse mobile sports app in Pennsylvania would also keep the pricing along the lines of NJ, Davis appeared even more confident. “What I would say is that to the extent that anything were to be different, that’s something that people would very easily be able to recognize, so we would need to have a good reason why we would make it different. But it’s not my expectation that anything will be at all different between Pennsylvania and New Jersey.”

So where will the difference be made?

The benefits of competitive pricing are almost too numerous to list. By setting an early precedent at its land-based book, SugarHouse Casino will encourage neighboring Philadelphia sportsbooks to keep the juice reasonable, or otherwise risk bleeding customers to other establishments. In addition, the casino is creating an environment where the casual bettor will get more bang for their buck, resulting in higher retention rates and an overall, more positive experience.

But considering the high cost of operating a sportsbook, along with the 36% tax rate and the hefty $10 million licensing fee, the idea of profitability is a reach even for Pennsylvania books that do hike up the vig. At a competitive rate, it’s pretty much a pipe dream. So what will they do?

One answer might be to reduce advertising spend, but that comes with the problems of lower brand awareness — not exactly ideal for an industry just finding its footing. Promotional cutbacks is another route, but again, without vehicles to get butts in the seats, books will fall short of reaching their long-term acquisition goals.

Alternatively, maybe books come to grips with the reality that sports betting isn’t a big money maker no matter what the conditions, and instead use it as a means of driving customers to its other attractions. This technique works well enough at a land-based casino, where a blackjack game or slot is never more than two feet from your face, and bettors watching the game are sure to get their eat and drink on, all at inflated casino prices.

It works even better online, where more often than not, PA sports wagering sites will be integrated with a similarly branded online casino, as is the case with Play SugarHouse in New Jersey. Earlier this year, it was reported that the site doubled its revenue in the first full month that the online sportsbook was live. We’re going to go out on a limb here and assume that it wasn’t only sports betting revenue responsible for the surge, but sports bettors crossing over to casino as well.

In Pennsylvania, five out of six licensed sportsbook operators, as well as Presque Isle Downs (which has applied for sports betting but has yet to receive board approval), have also opted into online gambling. For these properties, it’s likely that any losses incurred by online sportsbooks are going to more than make up for themselves via crossover to online casino, where bettors can easily access games like slots, that have higher margins for the casino and low overhead costs.