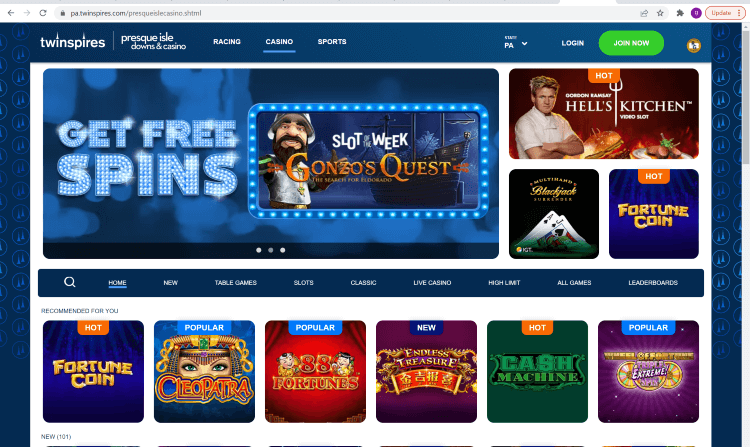

The days are numbered for the TwinSpires online sports betting and online casino site, and the question in Pennsylvania is whether gamblers will notice or even care when it’s no long longer an option.

Some will, but not many, based on monthly figures from the Pennsylvania Gaming Control Board showing that the online platform from Churchill Downs Inc. and attached virtually to Presque Isle Downs & Casino ranks well below most competitors in usage.

That lack of success — not just in Pennsylvania, but in other states where TwinSpires competes with the better-known entities like FanDuel and DraftKings — was part of the reason Churchill Downs CEO Bill Carstanjen announced in a Feb. 24 corporate earnings call that the company would withdraw TwinSpires from the iGaming space nationally within six months. It will continue to be operated for advance-deposit horse wagering.

TwinSpires provides online sports betting in seven states overall and iCasino play in New Jersey and Michigan in addition to Pennsylvania, but they don’t provide the revenue the company seeks, Carstanjen said.

“We had high hopes for the potential to build a profitable business in this space,” he told investment analysts. “We have profitable retail sportsbooks in four of our casinos (Presque Isle among them). However, the online sports betting and online casino space is highly competitive, with an ever-increasing number of participants that the states have licensed.”

Never a leader, by either of its names

When Churchill Downs first began its online Pennsylvania operations in December 2019 as BetAmerica (it transitioned to the TwinSpires brand last April), there were far fewer competitors than today, with 14 digital sportsbooks and 17 iCasinos now in the market.

But neither then nor now has BetAmerica or TwinSpires ever been a market leader. And to an unusual extent, the sportsbook has had trouble making money.

For 11 straight months from December 2020 to October 2021, the company reported a net revenue loss on sports bets in Pennsylvania after accounting for the promotional credits given away to customers. From its $32.6 million in sports betting handle in all of 2021, TwinSpires had $1.9 million in gross revenue, but -$912,241 in net losses after adjusting for the credits.

While $32.6 million might sound like TwinSpires took a lot of bets last year, there are four online sportsbooks in Pennsylvania — FanDuel, DraftKings, BetMGM, and Barstool — that each exceed that amount every single month.

TwinSpires has been able to turn its sportsbook losses around in the past three months with net revenue in the black, but is still just a bit player on the overall scene. It reported its biggest handle ever in January at $4.8 million, but that was well less than 1% of the total statewide betting volume of $737.4 million. To this end, TwinSpires took more bets last month than just three other sites: Caesars ($4.7 million), Betway ($2 million), and Betfred ($1 million).

The state gaming board’s financial reporting system for iCasinos makes it harder to track comparisons among individual operators in that realm. As with others, TwinSpires clearly generates more revenue from online slots and table games play than from sports betting, even if it is again relatively small in usage. The January report showed it with $1.4 million in online casino revenue out of the record $108.3 million statewide.

Once gone, it will be replaced

Pennsylvania gamblers may have multiple reasons not to mourn the loss of TwinSpires, once that occurs. For one thing, it was never among the biggest sources of special bonus and discount offers to new or existing customers, even if those did contribute to its reporting of net losses many months.

For another, its demise will have no impact on sports bettors who shop for line differences to gain an edge. TwinSpires relies on European-based oddsmaker Kambi for its game lines and prop bets, which essentially duplicate those of the many other sites in the state whose operators are also Kambi customers: BetRivers, PlaySugarHouse, Unibet, Barstool, and Parx.

And perhaps most importantly, rather than one less betting option existing once TwinSpires phases out, it is far more likely to simply be replaced. Pennsylvania has a limited number of online sports licenses available — the equivalent of one for each of the 16 retail casinos, with a $10 million cost attached to the license — and operators currently shut out of the state can reach a deal with Churchill Downs to take over its license. Carstanjen said on the earnings call to expect such a scenario.

While most of the major multi-state sportsbooks are already available in Pennsylvania, there are many companies operating elsewhere that would be attracted to a state with such a large population, even if it has unusually high online gaming tax rates. WynnBET, for example, has been prominent in other states, but has had no access to Pennsylvania.

And while the MaximBet brand of the Carousel Group announced in September that it expects to launch an online casino in the future in Pennsylvania, no evident path then existed for it to simultaneously launch an online sportsbook. Operators generally like to provide a shared platform for both sports bettors and casino players.

Carousel Group spokesman Doug Terfehr told Penn Bets at the time of the iCasino announcement, “We will explore sports betting opportunities in the state as well.”

A deal with Churchill Downs might well represent that opportunity — if not for MaximBet, then likely for some other operator that will give Pennsylvania’s online gamblers yet another new option to consider.