Think of all the loose change you could save from one trip out of the house when running a few errands.

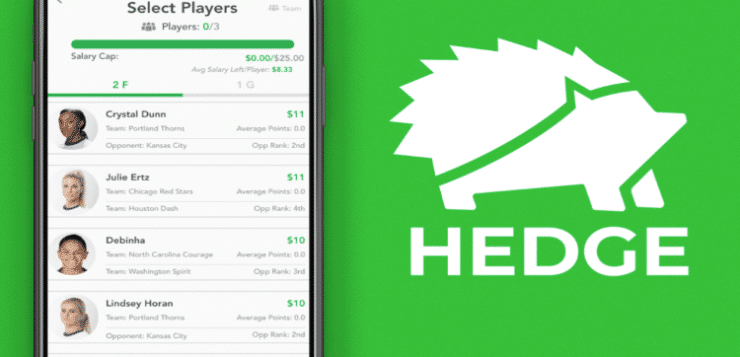

Taking a page from several well-known start-ups in the Fintech space, Hedge is the first gaming platform that allows users to convert digital change into fantasy sports. While interest in legal sports betting and daily fantasy sports has soared since the repeal of PASPA three years ago, innovation among gaming app platforms has lagged behind those offered through micro-investing apps, according to Hedge CEO Jackson Fitzgerald. Two in particular, Acorns and Stash, have cornered the market for a concept known as “spare change investing.”

Hedge, which bills itself as the “Acorns of DFS,” is leading the charge to catch up. A Pittsburgh-based company founded by three Penn State graduates, Hedge captured the inaugural Ifrah Pitch competition on May 27. The award is given to a promising start-up in the gaming industry.

Hedge has fielded numerous calls since then from investors interested in its next steps after learning about the company through the competition. Hedge beat out four other finalists, including ReSpo.Vision, a company which informs sports betting decision-making by harvesting data on every pitch, ball, and player movement through artificial intelligence.

Last November, Hedge completed an initial angel investment round of $250,000 — funding it used in part to conduct user testing and learn more about customer response to its DFS products. As Hedge plans to embark on another seed round this fall, the company anticipates that publicity gained through the competition will help garner additional interest.

“In the gaming space, the paradigm is a lot of money is required for user growth and user retention,” Fitzgerald told Penn Bets. “We’re well aware of the industry we’re in with that regard. We’re truly honored to win the award.”

The spare change movement

Unlike the major fantasy sports operators in the space, the majority of contests on Hedge offer miniscule entry fees — about the same as you might find under a couch pillow or a mat in your truck. Some contests on Hedge cost as little as 25 cents to enter, with top prizes for pool winners ranging from 5x to 40x a user’s entry fee. Others, particularly in golf, have steeper entry fees of $5 with a similar return on investment.

Golf players tend to participate in contests with higher fees since tournaments on the PGA Tour typically do not start until Thursday of a given week. Those players, however, often take part in 25- and 50-cent contests in addition to the larger ones, Fitzgerald noted. Customers are allowed to submit multiple entries for the pools.

Many contests on a major sports weekend will attract 40-50 entrants, said Fitzgerald, who completed his undergraduate degree from Penn State in 2019. A return of 10x is a good proxy for taking down the top prize, he added. Hedge is targeting millennials in their 20s, young professionals, and college students as its main customer base. The company’s eight-person staff works out of an office in the Bloomfield neighborhood of Pittsburgh, within a couple miles of the University of Pittsburgh and Carnegie Mellon. Hedge recently surpassed a benchmark of 1,000 downloads among unique users.

Big things coming to fantasy sports 🚀🦔 https://t.co/UmpbQ9bXy4

— Mitch Malinin (@mitchmalinin) January 20, 2021

A budgeting tool

A micro-investing app such as Acorns links “spare change” from a payment source (ACH transfer, debit card, credit card, checking account, etc.) into a separate investment portfolio. Let’s say a Pitt student buys a large coffee at Starbucks for $3.75. The app, whether it is an investment platform like Acorns or a DFS company like Hedge, will round up the purchase to the nearest dollar. In this case, the customer will have 25 additional cents on a purchase of $4.

An extra 25 cents in spare change might not appear much on one transaction, but it quickly adds up when a student completes a dozen transactions on a weekend. The customer can also transfer “round-ups” from gas purchases, meals, and any other payment made through a swiped card. When a customer buys a full tank of gas for $40.11, there is a round-up of 89 cents to $41; when a customer buys a dozen donuts for $11.39 in real-money, the round-up is 61 cents.

WIN BIG with Hedge's Pocket Picks! pic.twitter.com/Wj0neQsREa

— Hedge 🦔 (@hedge_sports) August 18, 2020

The spare change, in aggregate, is transferred to a separate portfolio for fantasy sports pools. Once the portfolio reaches at least $5, it automatically gets transferred onto a customer’s Hedge account, which the company dubs “Hedge funds.” With the purchase of coffee, donuts, and gas in the example above, the student would have $1.75 for fantasy sports contests on Hedge.

A snapshot of purchases for the weekend of June 5-6

| Year (May) | Slots revenue | Number of machines | Win per machine/day |

|---|---|---|---|

| 2021 | $12.6 million | 1,731 | $234 |

| 2018 | $17.2 million | 2,450 | $227 |

| 2016 | $18.2 million | 2,800 | $210 |

| 2014 | $19.5 million | 2,791 | $225 |

| 2012 | $22.7 million | 2,821 | $259 |

| 2010 | $25.8 million | 2,694 | $309 |

| 2008 | $31.3 million | 2,778 | $363 |

“Instead of their spare change going into a coin jar, they can use it on our site,” Fitzgerald said, adding a typical Hedge customer transfers about $25 in spare change into their wagering fund each month. Customers can also make lump sum payments.

While Hedge customers are limited to $5,000 in their account, they rarely approach it. Unlike low-cost mutual funds selected by a robo-advisor, Hedge does not automatically enter a customer’s funds into certain DFS contests. Hedge users have full discretion to pick and choose the contests they want to enter. Customers also have the option of turning off the “round-up” function at any time.

“It’s as easy as clicking an on-and-off switch,” Fitzgerald said. “We try to keep it as transparent as possible for when they turn on their round-ups that it is going toward their hedge account.”

For winning the Ifrah Pitch contest, Hedge received a cash injection of $5,000 and five hours of legal consultation with Ifrah Law to support the growth of the company.

“The entries in the Ifrah Pitch contest wowed us with their innovative visions for the future of this burgeoning industry,” Ifrah Law founder Jeff Ifrah said in a statement. “We are thrilled to support Jackson and all the other entrepreneurs seeking to expand online entertainment in ways that are safe, lucrative, and fun.”