Nearly six weeks after BetMGM began offering the first competition to PokerStars in Pennsylvania’s online poker market, one thing is clear: The newcomer has a lot of catching up to do.

In reviewing the two sites’ activity on multiple days recently, there were commonly as many as five to eight times the number of players using the PokerStars site as that of BetMGM.

BetMGM launched poker on April 27 at both of its online Pennsylvania sites, BetMGM and Borgata, using a shared platform that essentially functions as one poker option with players from both sites sharing the same tables and tournaments.

Revenue numbers for May will be released by the Pennsylvania Gaming Control Board next week providing the first official indication of how BetMGM is doing compared to PokerStars, which had the state’s market to itself from November 2019 until late April.

On its own, PokerStars was not growing the market. Its $2,345,056 in April revenue was its lowest total since the pre-pandemic days of February 2020. There was a flurry of increased activity after COVID-19 shut down casinos, forced many people indoors for months, and prompted a range of new online gambling play. The lone poker site’s revenue peaked at $5.3 million in April 2020, but it has been steadily decreasing in the months since.

Wide gap during both slow mornings and busy evenings

Penn Bets monitored traffic throughout the day on the two sites last Thursday and Saturday — every two hours between 10 a.m. and midnight — to gauge comparable activity at the cash games and tournaments offered by each. Each site shows a constantly updated total of the number of players logged on, as well as what cash game tables are available with the number of players seated, and what tournaments are ongoing with the number of participants.

Within the time frame examined, PokerStars hit its peak at 10 p.m. Thursday when it had 1,723 players logged on, with 109 cash games going at a variety of betting stakes options and some 650 players seated. Hundreds more were playing in tournaments or waiting for games or observing.

The BetMGM peak during the two days came two hours earlier, at 8 p.m. Thursday, with 279 players showing as logged on, about one-sixth the volume of its competitor’s high. At that time, it had eight cash games displayed, with 47 total players.

As might be expected, the morning hours saw the least traffic at both sites — a low of 278 logged on to PokerStars at 10 a.m. Saturday and 95 for BetMGM at 10 a.m. Friday.

It was typical for both sites to build their volume throughout the day, be at their busiest from 8-10 p.m, and then subside by midnight.

One difference is that PokerStars, by virtue of its broader customer base, is able to offer pot-limit Omaha cash games throughout the day at various stakes in addition to no-limit Texas hold’em, which represents the vast majority of cash games. BetMGM occasionally had a single PLO game taking place at one stakes level.

The stakes can be really high, or really low

Clearly, the 20-month experience of PokerStars in Pennsylvania gave it an advantage as the preferred outlet whether for high-stakes professional players sitting at a virtual table with thousands of dollars in cash or the most modest recreational players wagering pennies at a time.

At 10 p.m. Saturday, PokerStars had 17 players involved in four Texas hold’em games at the $5/$10 blind levels, which carry a buy-in range from $400 to $1,000. There was one PLO game ongoing at the same level. More than $12,000 in virtual chips were on the table belonging to the six players at one hold’em table.

At the same time, 34 players were seated at six games carrying blinds of $.01/$.02, meaning it took as little as 2 cents to see a flop and play a hand. Those players’ buy-ins ranged from 80 cents to $2. All of the combined chips of players at one table was less than $10, or insufficient to see a flop in one hand at one of the big tables.

Typically, the most popular stakes level for PokerStars was for games with blinds at either $.15/$.30 or $.25/$.50. At busy times, there might be eight to 12 tables of six seats offered for each, with waiting lists posted of several or more players waiting to get into games.

For BetMGM, there were typically one to two games available to play hold’em at five to eight stakes levels, and waiting lists were rare. Sometimes, however, there was even higher-stakes action than what PokerStars showed at the same time.

At 10 p.m. Saturday, BetMGM had four players seated at a $10/$20 table, when the $5/$10 game was the most expensive one going at PokerStars.

Tournaments also show wide difference

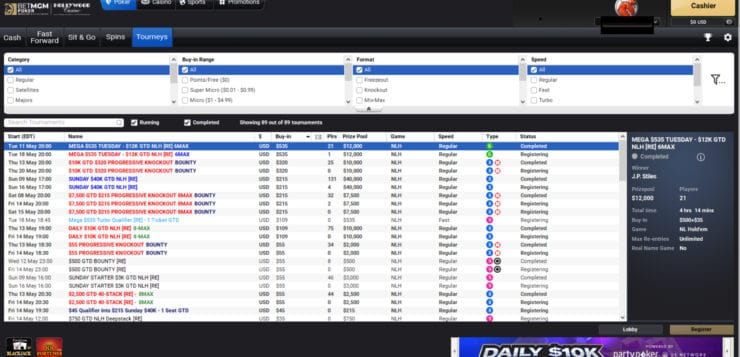

Of course, the sites rely on tournament activity to attract players as well, and BetMGM offers nearly as many options for those as does PokerStars, although again attracting a smaller number of players overall.

Sunday is a busy tournament day, and BetMGM’s site showed it held 24 tourneys at buy-in levels ranging from $1 to $55 with a combined total of more than 1,700 participants. PokerStars attracted about three times as many players with just a few more tournaments, which ranged from the $5 to $250 buy-in levels.

PokerStars is able to get more than 300 players to its most popular daily tournaments. At midnight Saturday, its 9 p.m. $20 buy-in Bounty Builder tourney with $6,500 in prize money was still running, with 358 having enrolled (with tournament enrollments counting the same player multiple times, if they rebuy).

BetMGM had also started a tournament at 9 p.m. Saturday, its nightly NLH Turbo game with a $10 buy-in and $1,000 prize guaranteed. That game had been completed by midnight, with 66 entrants. Its most popular tourney Saturday was a 9 a.m. Bounty NLH contest with a $5 buy-in and $600 in prize money, which attracted 143 participants.

BetMGM advertises its highest-stakes tourneys as a 7 p.m. game daily with a $109 buy-in and $10,000 in guaranteed prizes; a 5 p.m. Sunday competition with a guaranteed $40,000 given out to those buying in for $215; and its Mega-Tuesday Six-Max tourney at 8 p.m. with a $535 buy-in and at least $12,000 awarded.

Time and compacts will presumably boost BetMGM

Penn Bets reached out to BetMGM for comment on how its initial experience has gone in Pennsylvania compared to expectations or to its operations in other states — it launched poker in Michigan in March after previously operating only in New Jersey.

A spokesman responded that it was too soon to comment, as the company awaited a more concrete sample size with which to assess its progress.

It stands to reason that activity on the site will grow as more players become aware of the still-new option, whether through advertising or word-of-mouth. The most keen poker aficionados are presumably already aware.

What might become clear when revenue figures for May are released next week is whether the new activity on BetMGM — however small by comparison — is cutting into PokerStars’ revenue or growing the market overall.

Both operators, meanwhile, are looking forward to a day down the road when Pennsylvania and Michigan could join with New Jersey and other states in poker compacts that combine their players around the country for tournaments and cash games. That is expected to grow activity overall from more options becoming available, but there is no timeline yet for when regulators from the multiple states will agree to make new compacts possible.