Pennsylvania has “really screwed it up,” he said.

“A rolling dumpster fire is sports gaming in Pennsylvania,” he said.

“People are driving from Pennsylvania into New Jersey and sitting at our rest stops on their mobile phone and making bets,” he said.

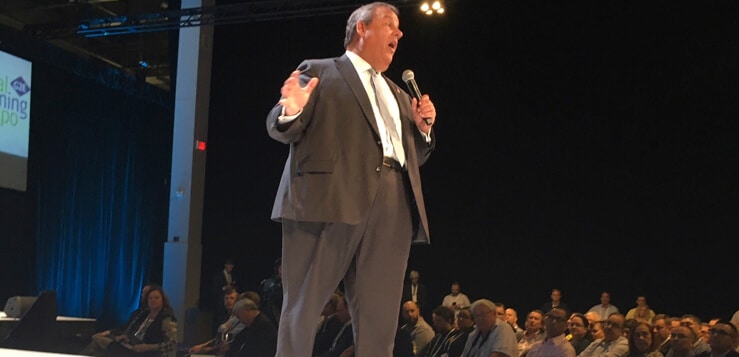

Those were but a few of the inflammatory, chest-beating assertions from former New Jersey Gov. Chris Christie in a keynote address last week at the American Gaming Association’s annual Global Gaming Expo event in Las Vegas.

As one who has no vested stake in how either New Jersey or Pennsylvania handles oversight of the ever-expanding gaming industry, but who has covered Pennsylvania’s experience with it for more than a decade and is a taxpaying resident of the state, I have but five words for Mr. Christie:

What … are … you … talking … about?

Elected officials serve taxpayers, not gambling firms

Based on Christie’s remarks, one would think that in his former life, his primary responsibility was to serve casino operators and shareholders rather than the citizens of his state. It would have been hard to support any of his claims with anything so simple as facts and numbers — that is not the politician’s way — so he engaged in rhetoric that would serve as red meat to his audience.

In doing so, he declined to note how — far from turning their back on Pennsylvania’s $10 mm licensing fee and 36% tax rate, as so many asserted would be the case — casino and sportsbook operators have nearly all entered the market to make money (I’m thinking they don’t pay hefty fees in order to lose money), serve customers, and compete with one another.

The result? The Pennsylvania legal sports betting industry that is still comparatively small, young, and growing is already benefiting the state more than in New Jersey, without any evidence that the consumers using it are disadvantaged.

In the month of September, Pennsylvania, with a 36% tax rate, derived $5.36 mm in tax revenue from $14.9mm in gross revenue on an overall betting handle of $194.5mm. The handle grew 78% and gross revenue soared 143.5% from the month before.

By comparison, New Jersey had a sports betting handle more than twice as high — $445.6mm — but its tax rates of 14.25% for online wagers and 9.75% for retail netted $4.54 mm for state coffers, or $815,540 less than Pennsylvania. Conservatively speaking, Pennsylvania appears bound to generate at least $10 mm more annually for itself from sports wagers than its neighbor to the east.

At the same time, there is no sign that Pennsylvania casinos are hurting from this financial structure. They have nearly all been willing to invest heavily in designing sizable, attractive retail sportsbooks, spending anywhere from $5 mm to $10 mm at the large casinos to $1 mm to $2 mm at the smaller ones. No one has set up a small, dark counter in a corner simply to tolerate sports bettors rather than welcome them.

Nor has anyone found that New Jersey bettors receive better odds and options for their wagers than their peers in Pennsylvania, which was another fear raised during the initial criticism of the Keystone State’s structure.

PA gambling has no spokesman, just a lot of revenue

I have seen no op-ed rebuttal from comparatively mild-mannered Pennsylvania Gov. Tom Wolf in recent days, nor would I expect it. He is not one to have championed how the state went about its wide-ranging gaming expansion of the past two years, and nor is there any legislative leader doing so; it was more a case of bipartisan agreement in November 2017 to address Pennsylvania’s budget woes without forcing anyone to subsequently defend a tax increase.

It was not brave — it was expedient — but it is working, if a government’s intent in legalizing new forms of gambling is more to bolster its own budget than the bottom line of a casino corporation.

There is no real spokesman for Pennsylvania’s approach, however, to make this case in response to Christie. That includes the Pennsylvania Gaming Control Board, which carries out the task of executing what was in the 2017 legislation but had nothing to do with its passage or contents.

“The continued growth of sports wagering revenue, such as just reported last week, is a testament of this gaming sector heading in the right direction in Pennsylvania,” was as far as PGCB spokesman Doug Harbach would go in an email when asked for reaction to Christie’s remarks.

Truth be told, no one publicly paid much attention to any 36% tax on sports wagering when the bill establishing it was enacted.

First of all, it was all hypothetical at the time, a Hail Mary provision that only became relevant with New Jersey’s challenge to federal law that ended with a positive U.S. Supreme Court ruling the following May.

Secondly and thirdly, there were no prior hearings at all on the legislation hashed out behind closed doors, and the eventual public debate focused on other provisions that weren’t subject to any speculative court decision: the additions of mini-casinos, casino-style gaming over the internet, truck stop VGTs, and more.

It was only after the court’s rejection of the Professional and Amateur Sports Protection Act that Pennsylvania’s comparatively high sports betting tax became publicly discussed as an issue.

Irony surrounded the critics and early entrants

Among Pennsylvania’s casino operators, the most vocal critic making comments in mid-2018 akin to Chris Christie’s in October 2019 was Penn National Gaming. And which casino operator subsequently became the first to open a sportsbook? Penn National, at Hollywood Casino near Harrisburg.

Among major out-of-state sportsbook operators eager to get a foothold in Pennsylvania, one notably outspoken about how the state was sabotaging the industry was William Hill via its CEO, Joe Asher. And which one partnered with Penn National in operating the first sportsbook? William Hill.

This is all strikingly similar to some of the concerns raised in 2004 when Pennsylvania, again with little public debate, enacted its original casino law that set a comparatively high slots tax rate that stands today at 54%.

Rather than recoiling, major casino operators vied aggressively for the chance to enter the new market. They have built 12 gambling halls — with a 13th under development in Philadelphia — that have thrived rather than struggled and that made a combined $3.25 billion in 2018 gambling revenue.

More to the point, from what might be the expected standpoint of someone responsible for the budget of a state, Pennsylvania’s take of $1.48 billion in tax revenue from the casinos’ winnings was far higher than that of any other state.

As for why Pennsylvania is able to get away with its tax rates and fees despite sniping from the industry and its backers, its sizable population of 12.8 million (nearly 4 million more than New Jersey) no doubt is a factor. No comparably sized state has entered into commercial gaming to the same extent, providing leverage to extract more from operators than would be the case in an Indiana or Iowa, or even New Jersey.

Sorry, but no one’s leaving PA to make a bet anymore

The fact is that if a state’s elected officials are to serve all of their constituents — not just those whose income and jobs are dependent on profits in any one industry, particularly one that carries some spinoff social ills — they do well by collecting as much government revenue as they can, so long as it stops short of preventing the private entrepreneur’s ability to have revenue exceed expenditures.

Christie’s assertions would have some credibility if there were any indication that Pennsylvania’s large tax piece of the gambling pie had resulted in closures, losses, or anything to the detriment of both industry employees and consumers. But as regional casino destinations go (which are different from the national tourism shrines of Las Vegas and, to a lesser extent, Atlantic City) there is little that Pennsylvania’s casinos are lacking in appeal for those who enjoy that type of diversion and spending.

As for the ex-governor’s statement that Pennsylvanians are still crossing the border into New Jersey to engage in mobile phone betting because it’s so much better for them than doing so at home, we’re curious which highway rest stops he’s using to survey motorists for his information.

On the online Play SugarHouse site operated by Rush Street Interactive in New Jersey, someone wanting to bet on the Sixers in their home opener Wednesday would have to give 6 points to the Celtics or pay -230 on the money line. On the Pennsylvania SugarHouse site? The same.

It would seem to defy reason that anyone in Pennsylvania, which has five online operators, is spending both time and gas money to cross state lines today for a sports bet. Yes, New Yorkers would be doing so while still lacking their own mobile/online option, but that’s another story.

As for this story, the takeaway here from Christie’s comments is that his preference of bluster over facts either indicates the massive embrace he wants from the casino industry or explains the difficulty he had mounting a successful 2016 presidential campaign.

As for the way Pennsylvania’s officials have maximized potential revenue from the gaming industry once they made the decision to invite it into the state, the question isn’t so much why they are doing it that way, but why other states haven’t chosen to do the same.