Pennsylvania’s fifth mini-casino project received Pennsylvania Gaming Control Board licensing approval Wednesday, overcoming objections from a competing gaming company that lost out on the bid to develop the venue in the State College area.

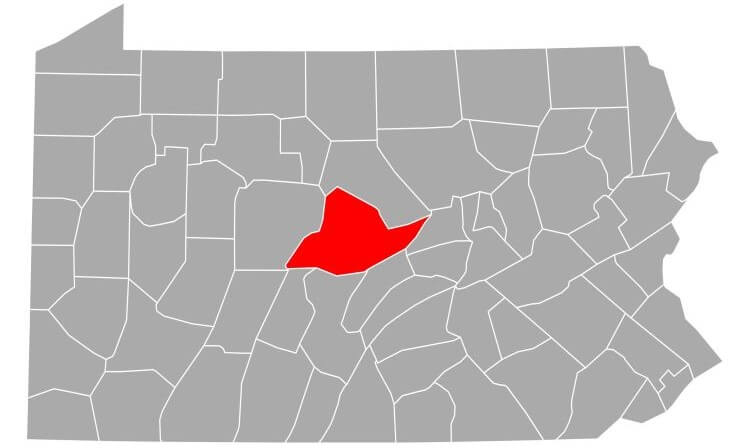

Without comment by board members following a nearly two-hour public hearing, they unanimously approved the plan to put a 94,000-square-foot casino into the former Macy’s department store space at Nittany Mall in College Township, Centre County. Philadelphia financier Ira Lubert, the licensee as founder and owner of SC Gaming OpCo LLC, is partnering with Bally’s Corp. on the $127.6 million venture.

The award of the license was vehemently contested once more Wednesday by Baltimore-based The Cordish Companies, operator of the two Live! casinos in Pennsylvania. One of those is a mini-casino in Westmoreland County, and it was beaten out by Lubert in his $10 million bid for development rights in Centre County at a September 2020 gaming board auction.

The board and its staff rejected Cordish’s contention that the agency violated the legislature’s intent in the Category 4 licensing process by accepting Lubert’s bid. Cordish, doing business as Stadium Casino in Pennsylvania, has made the same argument in a lawsuit it filed in Commonwealth Court, with a ruling still awaited. Cordish has 30 days in which it can file an appeal of Wednesday’s decision to the state Supreme Court, which would delay issuance of the license by the gaming board.

The project has also been protested by hundreds of State College area residents who sent letters of opposition to the gaming board, deeming commercial gambling contrary to the general character of the area, particularly with thousands of young Penn State University students living just a few miles away.

There was no mention of the public opposition at Wednesday’s hearing other than acknowledgement that it exists from Lubert’s attorney, Adrian King. He noted, however, that the project was widely supported by those who spoke at a prior public hearing in the local community in August 2021. The community opposition that has grown since then is based on general distaste with commercial gambling rather than merits of the project, he contended.

“I would submit that the commonwealth itself crossed that bridge back in 2004 when the gaming act was passed,” with any fears about the industry proving unfounded in Pennsylvania since then, King said.

Casino will open in 2024 at earliest

Although the Commonwealth Court case could still interfere with progress on the project, Lubert’s prospective casino general manager, Eric Pearson, estimated a year would be needed for a $35 million construction project to prepare the facility. He said it would be non-smoking and operate 24/7 with 750 slot machines, 30 table games, a sportsbook, restaurant/bar, live entertainment, and food court. It would provide 350 to 400 permanent jobs, Pearson said.

Lubert was previously lead investor and chairman of Valley Forge Casino Resort, with Pearson as CEO, before that casino was sold to Boyd Gaming Corp. in 2018.

Lubert, who built his wealth through private equity and real estate firms, told the board that he has longtime ties to the State College area as a Penn State graduate who went on to serve 17 years on the university’s board of trustees, including tenure as chairman.

He said he sees opportunity to help revitalize Nittany Mall — estimated to be about 50% vacant — and the economy of the broader community. Two of the three previously opened mini-casinos are located in malls themselves. The fourth is a Parx property opening this week in Shippensburg, which took over the space of a former Lowe’s home improvement store.

“Brick-and-mortar retail shopping has taken its lumps. … Shopping malls in particular have been hit hard, and this includes the Nittany Mall,” Lubert said. “With Penn State’s immense alumni base and other visitors and tourists flooding throughout the year, not just during football season, we will provide a new entertainment venue that everyone can enjoy.”

Cordish claims Lubert had improper help

Lubert was only able to bid on the project because of a tweak by the legislature so that not just existing Pennsylvania casino companies, but board-licensed individuals with ownership interest in any of those casinos, were additionally allowed to bid in the last auction. Lubert holds a small ownership interest in the Rivers Pittsburgh casino.

The challenge from Cordish’s Stadium Gaming arises over Lubert’s relationship with Bally’s and two individual business partners, Robert Poole and Richard Sokolov, who have been listed as officers of SC Gaming OpCo. Cordish has argued in court and with the board that the involvement of others in the project should invalidate Lubert’s bid, as neither the company nor those individuals were licensed for gaming in Pennsylvania. (Bally’s won approval Wednesday from the board to be licensed as a management company.)

“There are so many red flags” that the gaming board has ignored, Cordish attorney Mark Aronchick complained to board members in once more contending there’s been no fair hearing on its objections and its requests for more detailed information about the financing of the project. Cordish has raised the issue that if Lubert used funds from other investors to help with his initial $10 million payment to the gaming board, it should negate the bid.

Lubert’s attorneys stated that he was directly responsible for wiring $10 million from his personal bank account the day after winning the bid, that he could self-fund the entire project if he needs to, and his formation of SC Gaming OpCo and related companies to develop the casino fits with what has been customary among other gaming companies in Pennsylvania, including Cordish and its Stadium Casino subsidiary.

That viewpoint won concurrence from Cyrus Pitre, chief enforcement counsel for the gaming board, who said an extensive review of Lubert’s application was conducted by the agency’s staff without turning up any evidence that it was unsuitable or that the applicant had done anything at all unusual in the industry.

Image: Shutterstock